The Conservatives’ majority of 80 seats has removed one of the biggest political risks to investors. A hung parliament, let alone a Labour administration, will remain a distant possibility. The Prime Minister no longer needs to tread carefully to win votes in the Commons.

Yet, the actions of this single-party government – the first significant majority in the UK for over a decade – will be more complex to forecast. The dynamics of Parliament and politics have changed dramatically.

The unpredictability lies mainly in the tension between the pro-market impulses of the Conservatives and their awareness that their majority rests on a host of newly won seats, where concerns are very different from Tory heartlands.

There are several areas where the direction of Government policy – and the appropriate responses to it – can only be understood by in-depth analysis of these tensions and how various stakeholders inside and outside government will respond.

The new government will be more pragmatic than May’s and more willing to be flexible, but many ministers and advisors are keen to pursue radical agendas where it’s politically viable. Below we address some of the risks and opportunities the new government will bring, and how investors can use political and regulatory due diligence to address them.

1. Brexit

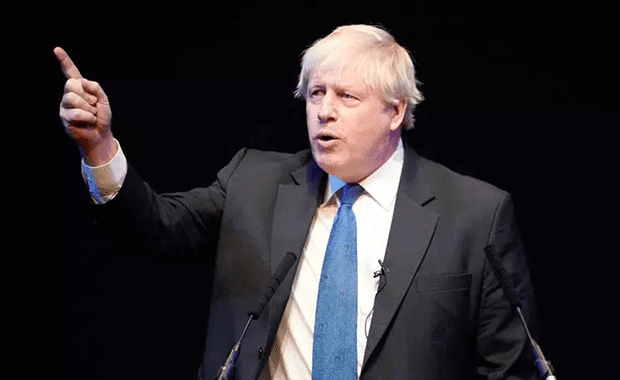

- The Conservatives’ majority allows Boris Johnson to pursue a Brexit deal without having to compromise with the ERG (the European Research Group of Tory MPs in favour of a hard Brexit) in one direction, or opposition parties in another.

- Johnson’s priority is likely to be greater divergence from EU regulations, which may increase costs and impact exports (especially where the EU makes imports more difficult).

- However, the 2020 timetable for negotiating trade talks may force more Government compromises as its priority is to ‘get Brexit done’ and move on to a domestic agenda.

- New limitations on EU migrant labour might affect labour costs and availability, especially in health & social care, hospitality, and food & agriculture.

- Financial and administrative burdens of hiring skilled workers from abroad could also increase, though overall access to skilled workers is likely to remain high under a new immigration system.

2. Deregulation and disruption

- The Conservatives can now pursue deregulatory agendas far more extensive than would have been possible in a hung parliament, including in areas like public health.

- This might mean that the regulatory costs of entry and participation in many sectors might go down, and incumbents might face more competition.

- The scope for challenger brands and regulatory space for disruptive tech and business models should also increase in this scenario.

- This would clearly bring associated risks. A decline in business standards as a result of lower scrutiny could threaten the reputation of a sector, and over the long term lead to a reinstatement or even tightening of regulation.

3. Public spending and taxes – increases and cuts

- Public spending is likely to go up in several well-flagged areas – especially health, education and transport.

- Adult social care could emerge as a medium-term priority, with a healthy majority potentially giving it the political capital to propose radical solutions, as well as a growing impetus for policy-makers to act to increase access.

- However, despite election campaign promises, Conservative fiscal impulses for sounder public finances are bound to make themselves felt, especially given the reluctance to countenance any significant tax increases to finance higher levels of public spending.

- This may result in slower-than-expected or negative real growth in public funding for certain sectors, restricting growth opportunities for some investor-backed businesses.

- Johnson and Sajid Javid’s instincts are to reduce the tax burden on households and businesses, but some wider tax reform beyond simply cutting headline rates is likely. Measures such as Entrepreneur’s Relief – which narrowly avoided being scrapped by Philip Hammond last year – could be candidates for reform or abolition if they are judged to be inefficient ways of stimulating economic activity.

4. Labour markets

- Nowhere will Conservative tensions be more apparent than in labour market reform.

- Post-Brexit restrictions on EU unskilled labour have already been mentioned as part of a future immigration system – an important issue for Conservatives as it links departure from the EU with tangible post-Brexit changes that many new Conservative voters will welcome.

- The Conservatives also know that the proposed IR35 reforms (very much a fiscally driven Treasury/HMRC initiative) could also negatively affect many self-employed voters, as well as the ability of business to access a flexible workforce. It might also affect the cost and timing of proposed new infrastructure projects.

- The Government is also committed to strong enforcement of labour market regulations: the director of labour market enforcement is Matthew Taylor – the author of the very influential Taylor Review of Modern Working Practices.

- The outcome could be some changes to the IR35 reforms and their implementation, alongside a renewed focus on better enforcement in order to regulate the gig economy – especially around the most egregious practices.

5. Private pay

- The Conservatives are determined that they cannot ever be portrayed by the Opposition again as being in favour of NHS privatisation or at risk of becoming an American-style health service.

- In practice this means that the Conservatives are likely to further increase NHS funding and avoid any high profile contracting out of clinical services.

- But this would not rule out measures to facilitate more private pay options, in health and social care and education, either through insurance or direct payment.

6. Public procurement and structure of government

- Dominic Cummings, the Prime Minister’s key adviser, has written at length about problems with Whitehall (from poor project management, inertia and weak incentives).

- Significant short term change is unlikely, but one can expect big changes in procurement and government project management (with perhaps more rigorous management and appraisal of current and potential projects and contractors).

- But the Conservatives – or, rather the Cabinet Office – have been pursuing a quiet revolution in procurement for some time – driving a more systematic approach to procurement across Whitehall and creating more opportunities for SMEs to bid successfully, while trying to loosen the hold of some of the biggest government contractors, especially post-Carillion.

- We can expect this to continue but married to significant reforms to change incentives in Whitehall and bring in more private sector expertise (mainly through recruitment than via contracts with the big consultancies).

- Exit from the EU may also bring a more ‘UK-first’ approach to tendering, though the UK has historically been very open to awarding contracts to foreign companies in infrastructure, energy and defence.

7. Education

- Skills and technical education have been made a clear priority by the Government, and this is likely to be reinforced by the Conservatives’ election victory. One of the dynamics that emerged in analysis of the 2019 election result is a swing among non-graduates towards Johnson’s party and a shift away from it by graduates.

- This is already an area subject to significant change with the introduction of T-levels and likely reform to the apprenticeship levy; outside of the focus on schools spending, we can expect this to be at the forefront of the Government’s thinking.

In short, while a comprehensive Commons majority allows the Prime Minister to be decisive on Brexit, the new complexion of the parliamentary Conservative party will be important in how domestic policy priorities are shaped over the next five years.

This new environment requires a different approach to political and regulatory due diligence. Identifying and responding to policy-driven risks and opportunities will take a more nuanced approach, alert to rapidly changing dynamics within government and Conservative policy making circles. Actions to mitigate risks and leverage opportunities will also need to be different, to resonate with new political stakeholders and agendas.

For more information on how GK can help investors and companies negotiate and adapt to this new environment, please contact us at martin@gkstrategy.com.